Box sets » Economic and fiscal outlook - March 2011

In each Economic and fiscal outlook we publish a box that summarises the effects of the Government’s new policy measures on our economy forecast. These include the overall effect of the package of measures and any specific effects of individual measures that we deem to be sufficiently material to have wider indirect effects on the economy. In our March 2011 Economic and Fiscal Outlook, we made adjustments to our forecast of inflation.

At the time of publication, oil prices had risen by £15 since the previous forecast. This box, from our March 2011 Economic and fiscal outlook, considered the potential economic implications, including the short-run effects on inflation and household consumption as well as possible longer-run effects on potential supply and the equilibrium capital stock.

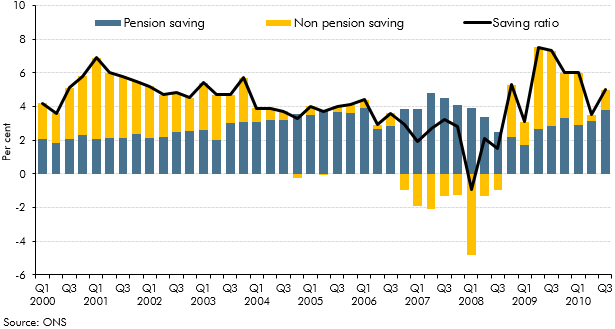

The household saving ratio captures both the disposable income that households do not spend on consumption, and changes in the equity households have in pension funds. This box described how the household saving ratio is calculated, and considered the relative contribution of pension and non-pension saving to the saving ratio over the preceding decade. The box also discussed possible factors behind recent movements in pension saving.

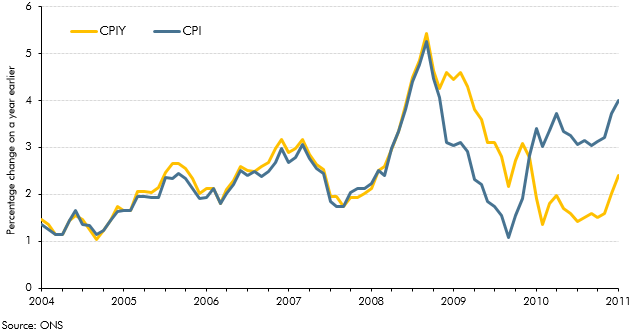

In the years prior to our March 2011 forecast there had been a number of changes to the rate of VAT, which affected CPI inflation. The Consumer Price Index excluding indirect taxes (CPIY) provides a measure of inflationary pressures excluding the effects that policy changes have on the CPI measure. This box considered how changes in VAT had contributed to the difference between CPIY and CPI at the time and what this meant for underlying inflationary pressures.

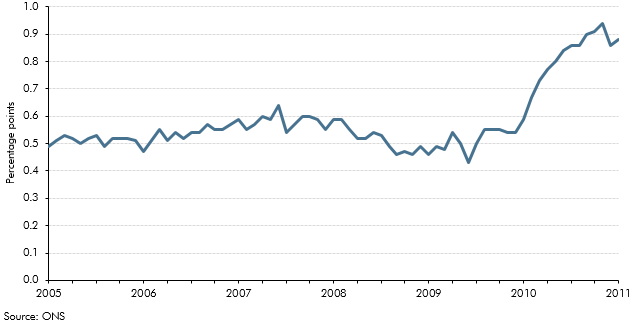

One of the key differences between the CPI and RPI inflation measures arises from the formulae used to construct the indices. In the year leading up to our March 2011 forecast, the contribution of this 'formula effect' to the divergence between CPI and RPI inflation had increased. This box explained the possible implications for our long-run assumption about the CPI-RPI wedge and our inflation forecast.

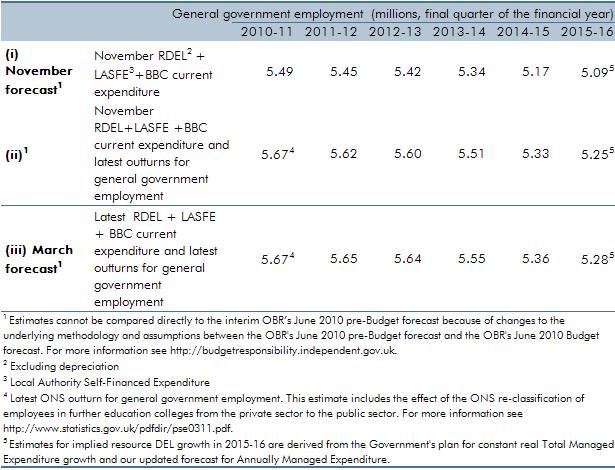

Our general government employment (GGE) forecast is based on projections of the growth of the total government paybill and paybill per head, which is in turn based on the Government's latest spending plans. Ahead of our March 2011 forecast, ONS estimates of general government employment were revised up, largely reflecting the reclassification of employees in further education colleges. In this box we set out the extent to which changes to our general government employment forecast were a result of our revised projections for paybill growth as opposed to data revisions.

In our central forecast, interest rates are assumed to evolve in line with financial market expectations. For alternative economic scenarios which involve different paths for the output gap and inflation, it is useful to specify rules for the way monetary policy is set and for how output and employment will respond. In this box, we set out the rules that governed those relationships in the scenarios we analysed in the March 2011 Economic and fiscal outlook: a persistent inflation scenario and a weak euro scenario.

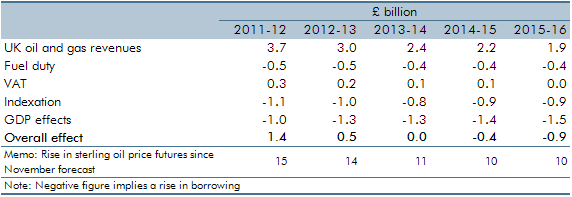

The world price of oil increased sharply in 2010, reflecting rising world demand and unrest in the Middle East and North Africa. This box explored the impact this had on our public finances forecast at the time, from higher North Sea oil and gas revenues to the second round effects stemming from higher inflation.

The Government undertook a number of interventions in the financial sector in response to the financial crisis and subsequent recession of the late 2000s. This box provided an update of the estimated net effect of them on the public finances as of March 2011.

This box set out the various impacts that higher inflation has on the public finances. These include direct effects (e.g. on income tax and debt interest spending), the impact on nominal tax bases (such as household consumption) and the impact on departmental spending.